Governance Initiatives

Approaches and Policies

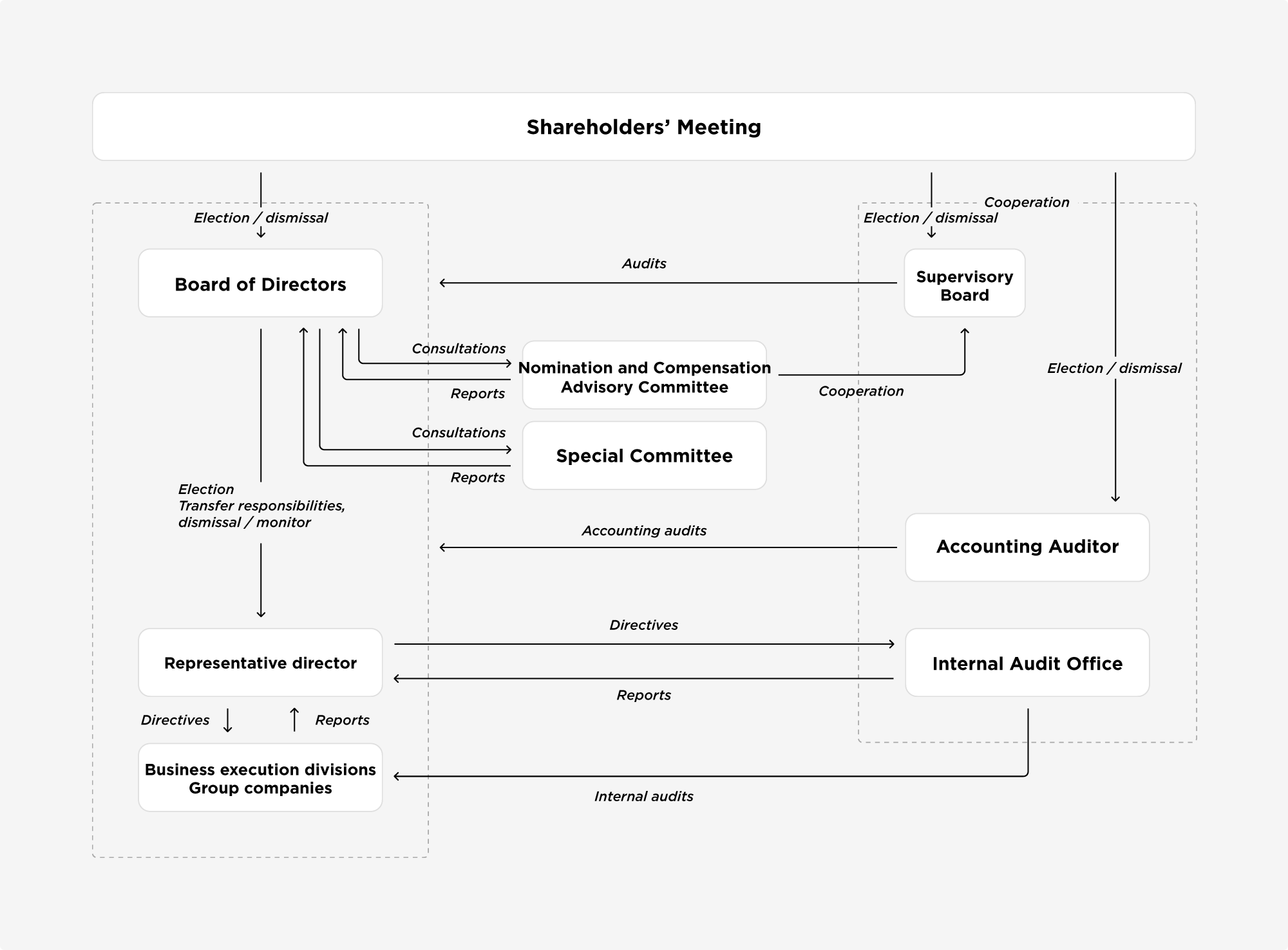

At CARTA, we believe that responding swiftly and accurately to changes in the management environment, improving management efficiency and transparency, and increasing corporate value are important management issues based on the fundamental policy of focusing on shareholders, employees, business partners and other stakeholders. To strengthen corporate governance, we collaborate with the board of directors to improve management efficiency and transparency by making effective use of internal audits and the auditing functions of the supervisory board members, and of functions that control the internal organization and the division of business tasks.

Initiatives

Corporate Governance System

Board of Directors and Directors

The board of directors is composed of six directors. In addition to the regular board meetings held once a month, the board holds extraordinary meetings as necessary. As well as supervising the status of the duties of the directors in the presence of the supervisory board members, the board of directors considers the validity, efficiency, and fairness of the management as appropriate. The board resolves matters that are stipulated by law and in the articles of incorporation, as well as important business matters, and makes decisions about business execution. As well as acting as chair and supervising the board of directors, the president and representative director enforces the resolutions of the board and supervises all company operations.

Audit & Supervisory Board

The audit & supervisory board is composed of three members in total, two outside supervisory board members (including one full-time supervisory board member) and one supervisory board member. The board holds regular meetings once a month to monitor the business environment and to supervise the decision-making process. Each supervisory board member attends the meetings of the board of directors. As well as interviewing board members, viewing important approval documentation, and providing advice and making recommendations related to management validity, efficiency, and fairness, the supervisory board members supervise the board’s decision-making process and the execution of business. We have reinforced the auditing functions by cooperating with an auditing firm and the internal audit office.

Internal Audit Office

Where the establishment and maintenance of the compliance structure is concerned, the internal audit office is directly supervised by the president and representative director. As the department responsible for internal audits, the office regularly audits the compliance situation, the management situation, and the validity and accuracy of business implementation at all departments, including group companies, based on the internal audit regulations. The office reports to the president and representative director. The office reports the results of internal audits and the status of corrections to the supervisory board members for an exchange of opinions.

Accounting Auditor

We have appointed KPMG AZSA LLC as accounting auditors to conduct audits based on the Companies Act and the Financial Instruments and Exchange Act.

Management team

For more information on management team at the company, see the Board Member page.

Analyzing and Evaluating the Effectiveness of the Board of Directors

Aiming to further improve the effectiveness of the board of directors, we conduct an annual review of the CARTA board of directors. To understand the issues that should be the focus in the next fiscal year and beyond, we conduct a questionnaire survey of all directors and supervisory board members concerning issues such as the composition of the board, the operation of the board, the agenda for the board, and the systems supporting the board. The secretariat of the board of directors analyzes and evaluates the effectiveness of the board based on the survey results, and reports the results of the evaluation to the board of directors. We have confirmed that there are no issues with the effectiveness and validity of any items under the current board of directors. In the future, we will make efforts to reform and improve issues identified through the evaluations and strive to further improve the functions of the board of directors. See the Corporate Governance Report for specific results of the questionnaire survey.

Policy for Determining Remuneration for Directors

1.Policy for determining executive remuneration

At a meeting held on March 25, 2023, the board of directors resolved the policy for determining remuneration for individual directors.

With regard to the remuneration for individual directors for the fiscal year under review, the board of directors confirmed that the methods for determining the details of remuneration, and the details of the remuneration are consistent with the decisions by the board of directors, and in line with the decision policy.

The details of the policy for determining the remuneration of individual directors are as follows.- a.Basic Policy

We position directors’ remuneration as an important element of corporate governance. The following are the guidelines for determining the system of remuneration and the details of remuneration.

(1) The remuneration promotes implementation of management philosophy

(2) The level and structure of the remuneration facilitates securing and retaining high-quality human resources

(3) The remuneration reflects the medium to long-term management strategies and provides strong motivation for growth in the medium to long term

(4) The remuneration incorporates a mechanism to curb irregularities and bias toward short-termism

(5) As guaranteed by an appropriate decision process, the remuneration is designed to be transparent, fair, and reasonable from the perspective of accountability to shareholders, employees and other stakeholders.- b.Remuneration Structure

The remuneration for directors and for executive directors consists of a fixed basic remuneration and performance-linked remuneration (cash remuneration, or stock remuneration in the form of share acquisition rights). In consideration of their duties, non-executive directors, including outside directors, are only paid the basic remuneration.

- c.Determining directors’ remuneration

Aiming to strengthen the fairness, transparency, and objectivity of the process related to the nomination and remuneration of directors, we have established a voluntary nomination and compensation advisory committee where the majority of members are independent outside directors. The remuneration system for directors and the remuneration amount for individual directors are determined by the board of directors based on the deliberations at the nomination and compensation advisory committee.

- d.Policy for determining basic remuneration amounts (cash remuneration) for individual directors (includes policy for determining the timing or conditions of remuneration)

The basic remuneration for company directors is a monthly fixed remuneration. The amount is determined by taking account of the business performance of the company, and the standard at other companies based on the role, contribution, and years of service.

- e.Policy for determining performance-linked remuneration (including non-cash remuneration) details and amounts (including policy for determining timing and conditions of remuneration)

To raise awareness of the results of business execution, the performance-linked remuneration will be cash remuneration, or stock remuneration in the form of share acquisition rights that reflect the performance indicators determined by the board of directors.

Cash remuneration is an amount calculated based on the target value for performance indicators in each fiscal year, and paid out as a bonus at a fixed time every year. The values of the targeted performance indicators are consistent with the medium-term management plan, and will be revised as appropriate to reflect changes in the environment.

Regarding stock remuneration in the form of share acquisition rights, the company board of directors (or the general shareholders’ meeting, if required by law) determines the issuance of share acquisition rights and its content (the number of share acquisition rights, money paid in exchange for share acquisition rights, and other necessary matters pertaining to the issuance of share acquisition rights).- f.Policy for determining the ratio of cash numeration or performance-linked remuneration (including non-cash remuneration) to the amount of remuneration for individual directors

The ratio of remuneration by type of executive director is determined by the board of directors based on the benchmark remuneration standard at corporations of a similar scale in related industries or business categories.

Nomination and Compensation Advisory Committee

Aiming to ensure fairness, transparency, and objectivity in the process of nominating and remunerating company directors, we have established the nomination and compensation advisory committee as a voluntary advisory body where the majority of members are independent outside directors. The committee deliberates matters related to the nomination and remuneration of directors in response to inquiries from the board of directors, and submits its reports to the board of directors.

Information Security

1.Information Security Committee

Aiming to strengthen the governance system for information security at the company, the information security committee regularly meets to deliberate and share information. The committee carries out risk assessments, formulates training plans, and improves incident responses. The committee chair leads on planning and regular reports to the management meeting, and each committee member promotes risk management and improvement measures in their own department.

2.Initiatives relating to AI

To create business opportunities using generative AI, we are promoting the social implementation of generative AI. In cooperation with all companies in the CARTA HD Group, we have set up the CARTA Generative AI Lab to research and develop, and promote the internal use of generative AI in the company.

We have also formulated guidelines for the use of generative AI in order to properly manage the risks associated with generative AI and to promote appropriate use of AI, including generative AI.3.Obtaining ISO/IEC 27001 Certification

Aiming to appropriately manage risks related to information security and to make effective use of information, we have obtained the ISO/IEC 27001 certification, an international standard, and established an information security management system.

Risk Management Committee

We have highlighted robust risk management as one of the CARTA materialities (key issues). In order to establish a risk management structure, to prevent risk and to minimize loss to the company, we are actively working on risk management. We have set up a risk management committee and we have formulated risk management regulations that stipulate matters related to risk management across the Group.

Disaster Response Headquarters

Aiming to secure the lives and safety of our employees as well as business continuity in case of a large-scale earthquake or other disaster, we have formulated guidelines for disaster responses, set up a disaster response headquarters, and established guidelines for preparations during normal conditions and for specific responses in the event of a disaster.

Corporate Governance Report

The Company has submitted its Corporate Governance Report to the Tokyo Stock Exchange(Japanese only).

Download PDFCompliance

-

1.Compliance initiatives

-

We have set up the following systems to ensure that our corporate activities comply with laws and regulations and the articles of incorporation.

(1) We have formulated internal rules, including rules for the board of directors, and made them available for inspection on the in-house systems.

(2) We have established an internal audit department and carried out internal audits based on the internal audit regulations to ensure that the officers and employees carry out their duties in an appropriate manner.

(3) The legal department has established an education and training structure for officers and employees.

(4) We have established an in-house reporting service concerning infringements of laws and regulations, or other matters of compliance.

(5) We have categorically rejected requests from anti-social forces or organization, and severed all ties with anti-social forces or groups. -

2.Compliance education and initiatives to instill awareness

-

We provide training for new graduate employees and mid-career hires when they join the company. In addition to regularly running company-wide compliance training, information security training, and personnel training on issues such as harassment, we continue to provide training to raise awareness of compliance and integrity, such as education based on business characteristics, legal revision, or societal demand.

-

3.Initiatives to eliminate anti-social forces

-

We have established a code of ethics to implement compliance. The code states that by developing and providing products and services that are useful to society while paying due attention to the safety and protection of personal information and customer information premised on laws and regulations, we gain the satisfaction and trust of consumers and customers. The company policies and standards also state that we will resolutely eliminate any association with anti-social forces and organizations that pose a threat to the order and safety of civil society.

As a result, we take advantage of important meetings, compliance training, and other opportunities to raise awareness of the code of ethics.

As part of a system to eliminate anti-social forces, we have established guidelines for responding to anti-social forces with the legal department operating as the competent department.

Specifically, based on the regulations for managing transactions, we use external services to gather information and perform prior checks on new business partners. We also perform repeat checks of all continuing business partners at least once a year. The basic contract concluded with business partners includes a clause excluding anti-social forces, stating that the contract can be terminated if it is found that a business partner is involved with anti-social forces. -

4.Hotline

-

We have set up a hotline (internal reporting desk) for anonymous consultations regarding infringements of laws and regulations or compliance by the company or a group company(Japanese only).

Hotline

Data

| Data Items | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Directors | Total number of directors (persons) | 8 | 7 | 7 |

| Outside directors (persons) | 4 | 3 | 3 | |

| Independent directors (persons) | 4 | 3 | 3 | |

| Female directors (persons) | 1 | 1 | 1 | |

| Non-Japanese directors (persons) | 0 | 0 | 0 | |

| Attendance rate at board meetings (%) | 99.00 | 98.81 | 98.81 | |

| Supervisory board member | Total number of supervisory board members (persons) | 3 | 3 | 3 |

| Outside supervisory board members (persons) | 2 | 2 | 2 | |

| Independent directors (persons) | 2 | 2 | 2 | |

| Attendance rate at board meetings (%) | 100 | 100 | 100 | |

Promotion Structure